Welcome to the latest AI Leadership Weekly, a curated digest of AI news and developments for business leaders.

Top Stories

Everything from OpenAI Day 2025: apps, agents, and more

OpenAI is turning ChatGPT into a full-blown app platform, launching an Apps SDK so developers can build interactive apps directly inside ChatGPT, plus a new AgentKit to make production agents less painful to ship. They also pushed Codex to general availability on a new GPT5-Codex model, and opened API access to GPT5 Pro and a preview of Sora 2 for video (read more below).

ChatGPT apps and monetisation. The new Apps SDK, built on MCP, lets devs connect data, trigger actions and render UIs in-chat. OpenAI says an app directory and “agentic commerce protocol” for instant checkout are coming, which hints at a platform tax later.

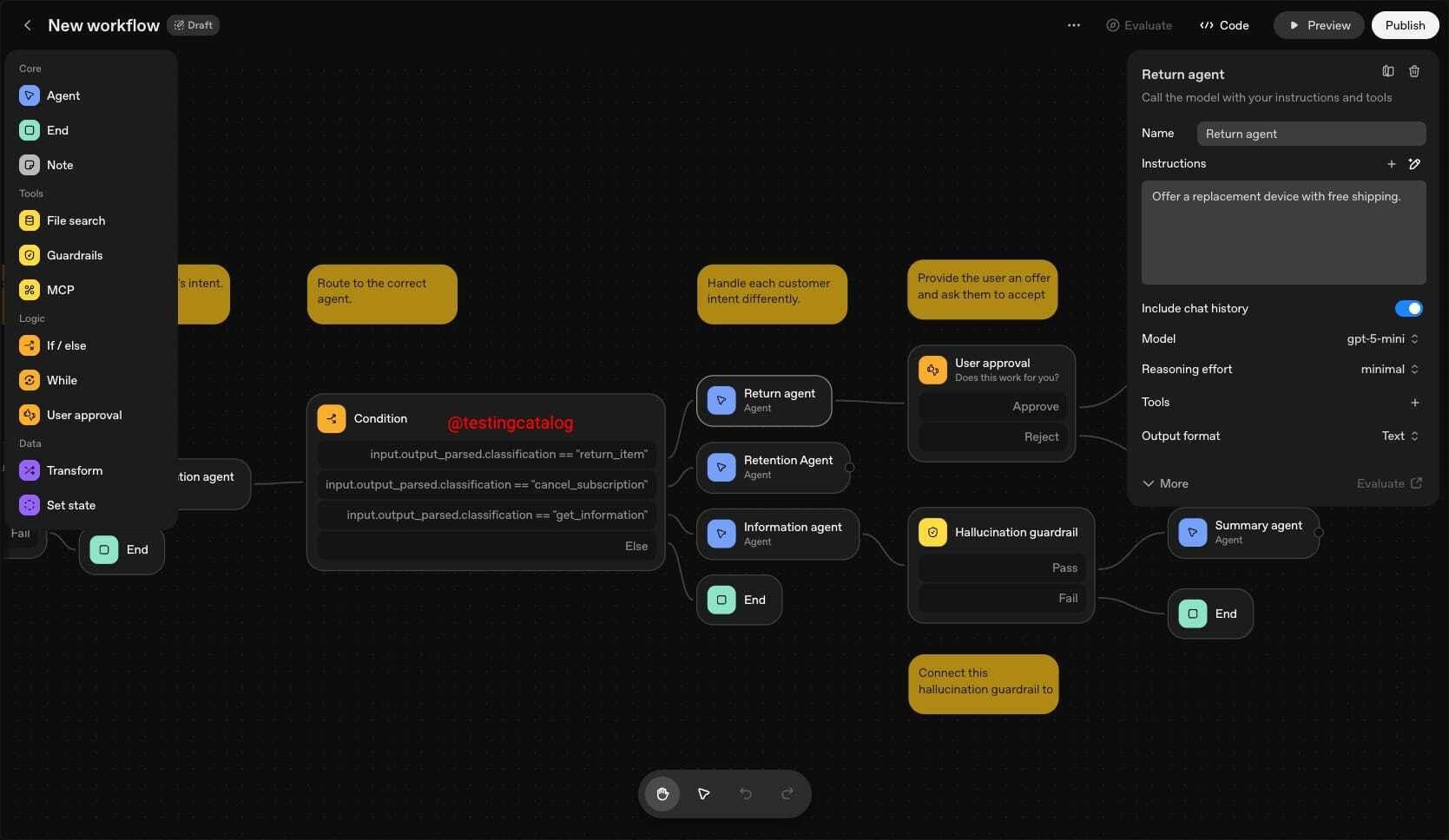

AgentKit for operational agents. AgentKit bundles a visual workflow builder, embeddable chat UI and agent evals, plus a connector registry for enterprise tools.

Coding and models get upgrades. Codex is GA with GPT5-Codex and a Slack integration, SDK and admin controls. OpenAI claims 70% more PRs per week internally and “40 trillion tokens” served. GPT5 Pro hits the API, a cheaper GPT-RealTime-Mini voice model lands, and Sora 2 gets an API preview with synced audio.

The bottom line: OpenAI wants to be the operating system for agentic apps, with distribution, payments and tooling all inside ChatGPT. If they pull this off, developers get reach and speed, but accept platform risk, review guidelines and potential fees. The strategic question is whether building your product inside ChatGPT grows your business or OpenAI’s.

Source: FT, Citi Research

OpenAI’s AMD compute play

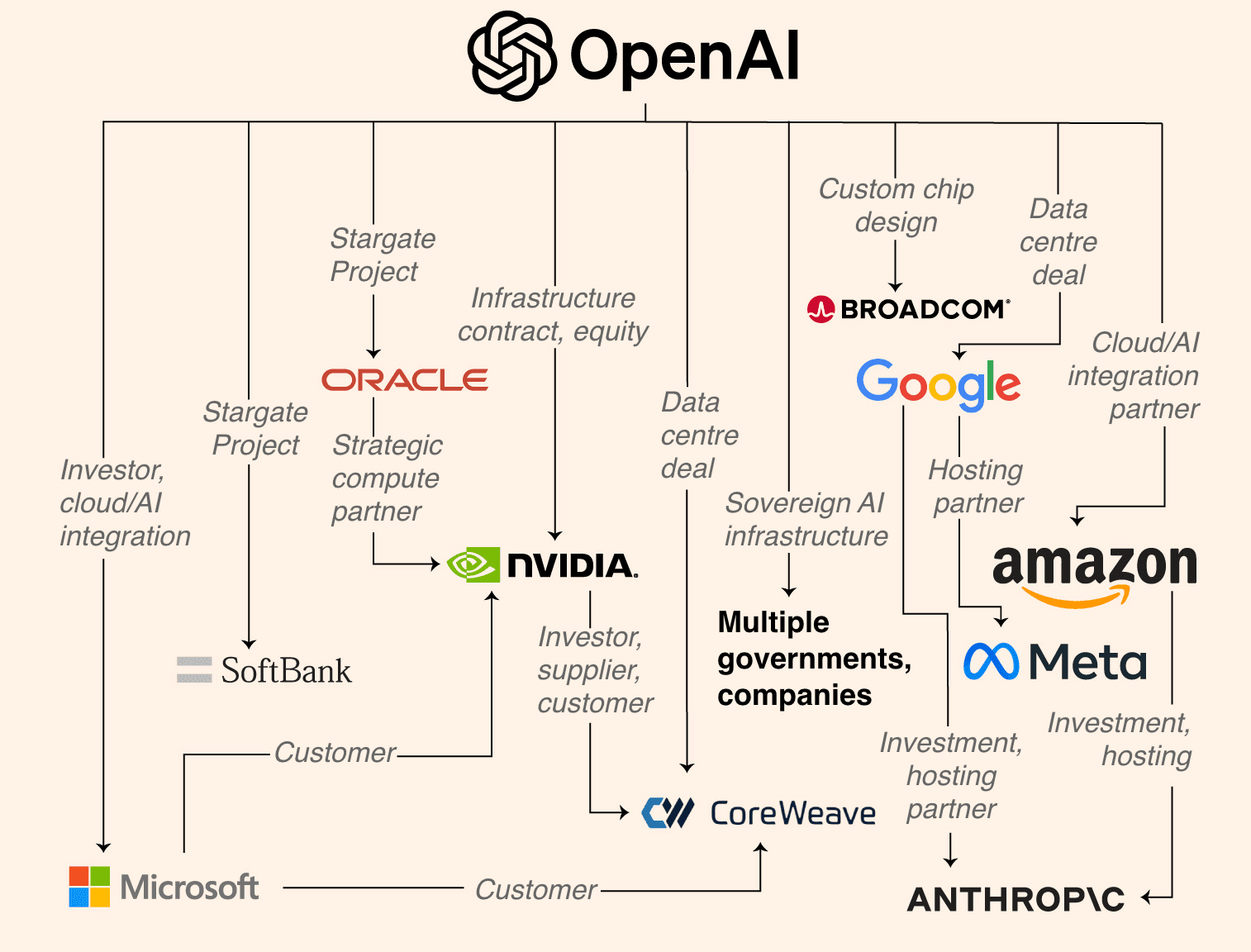

OpenAI has signed a five‑year, multibillion‑dollar deal to buy 6 GW of AMD’s upcoming MI450 chips, which they say will help ease an acute compute crunch and directly challenge Nvidia’s dominance. AMD called it a “definitive” agreement and told investors it could mean tens of billions in revenue by 2027, which sent AMD shares up 23.7% on the day.

Mega‑buy with unusual incentives. OpenAI gets warrants for up to 160 million AMD shares at 1 cent each, issued in phases if deployment milestones are met and AMD’s stock is higher. They plan to start with 1 GW in the second half of next year for inference workloads.

The price of power. AMD says building 1 GW of AI compute costs “tens of billions” which implies a colossal capex bill for OpenAI and partners. OpenAI reportedly expects $16 billion in server rent this year which could rise to $400 billion by 2029, while revenue is tracking around $13 billion.

Arms race context. Nvidia still has over 70% share and is touting its next Vera Rubin platform for 2026 as more than twice Grace Blackwell. OpenAI also has a letter of intent for a $100 billion circular deal with Nvidia and a $300 billion Oracle agreement, plus a $10 billion Broadcom chip project.

Why it matters: Compute scarcity is becoming the strategic bottleneck in AI which means whoever secures supply wins time and leverage. This deal de‑risks OpenAI’s dependence on Nvidia and hands AMD a flagship customer, but the financing and execution risks are huge. If demand softens or timelines slip, these trillion‑dollar build‑outs could look bubbly very quickly.

In Brief

Market Trends

OpenAI launches Sora 2

OpenAI launched Sora 2, a video and audio generation model that they claim is more physically accurate, realistic and controllable, plus a new social iOS app built around “cameos” where you can insert your likeness and voice into generated scenes. They pitch this as a “GPT‑3.5 moment for video” which means better physics, multi‑shot continuity and synchronised dialogue and sound. Big claim, big hype, and no independent benchmarks yet.

A push for ‘world simulation’. OpenAI says Sora 2 models failure (such as a basketball rebounding off a backboard) as well as success, and follows intricate instructions across shots.

A consumer app with guardrails. The invite‑based Sora app launches in the US and Canada and leans into remixing and friend‑centric creation. They say they are not optimising for time spent, have teen limits and parental controls, and users control who can use their cameo.

Monetisation and access. It starts free with “generous limits” although compute is a constraint. The only stated plan is optional payments for extra generations, and they plan to release Sora 2 in the API.

Why it matters: If Sora 2 really closes the gap on physics and control, that reshapes video production workflows and accelerates synthetic media adoption. The cameo feature is powerful which means it raises obvious deepfake and consent risks, even with the controls they describe. For leaders, this is another nudge to plan for synthetic content in products and policies, while insisting on independent evals before believing the “world simulator” narrative.

Jony Ive/OpenAI collab hitting snags

OpenAI and Jony Ive’s first AI hardware is running into thorny technical and infrastructure problems, which could push back a planned launch next year, according to the Financial Times. The secretive device is reportedly a palm-sized, screenless assistant that listens and sees, then responds through voice. That sounds bold, but sources say core issues are unresolved, from privacy and product “personality” to the sheer compute needed to run it at scale.

A bigger ask than a smart speaker. The gadget is said to be always on, collecting data via cameras and microphones to build “memory” and context. Teams are wrestling with its “voice” and mannerisms so it chimes in when useful and knows when to stop talking.

Compute and cost are the choke point. One person close to Ive said, “compute is another huge factor for the delay,” and that OpenAI struggles to get enough capacity for ChatGPT, let alone a mass‑market device. Budgeting for inference at consumer scale is a live concern.

Tough market, heavyweight team. Humane’s AI Pin has been scrapped and pendant companions drew “creepy” reviews, which mean the bar is high. OpenAI acquired Ive’s firm for roughly $6.5bn, has hired ex‑Apple and Meta talent, and is said to be working with Luxshare, with possible assembly outside China.

The big picture: If OpenAI and Ive crack an ambient, privacy‑safe, always‑on assistant, it could challenge the smartphone era. The hurdles tell a different story for now which is that turning frontier models into viable consumer hardware requires breakthroughs in UX, governance and cheap, abundant compute.

Tools and Resources

Monitors competitor (of your own!) websites, then generates weekly reports with meaningful changes.

Try the video app that's been flooding your feed lately!

Hit reply to let us know which of these stories you found the most important or surprising! And, if you’ve stumbled across an interesting link/tweet/news story of your own, send it our way at [email protected] It might just end up in the next issue!

Thanks for reading. Stay tuned for the next AI Leadership Weekly!

Brought to you by Data Wave your AI and Data Team as a Subscription.

Work with seasoned technology leaders who have taken Startups to IPO and led large transformation programmes.